Australian construction companies that will thrive during the recent consolidation will blend corporate strategy and digital analytic strategy. CFOs will move away from traditional models to adopt digital strategic planning models that rely on data insights while making decisions. Aspen Medical CFO, Moazam Shah, noted some of the key competencies for finance professionals to thrive in a digital ...

Australian construction companies that will thrive during the recent consolidation will blend corporate strategy and digital analytic strategy. CFOs will move away from traditional models to adopt digital strategic planning models that rely on data insights while making decisions.

Aspen Medical CFO, Moazam Shah, noted some of the key competencies for finance professionals to thrive in a digital world, including knowledge of digital technologies, ability to articulate their use to a wider audience in the business, an ability to learn and adapt to changes in technologies, and to a motivation to embrace new ways of working.[1]

“My role has not just been about ramping up our global finance workforce to support COVID projects and facilitate fast-moving projects. Above all, my key goal has been to drive digital transformation. Thank goodness we have the technology, which has supported us in everything we do”[2]

said Aspen, CFO Moazam Shah.

CFOs are becoming catalysts for growth

A Brainyard survey of leaders across 21 industries showed that most CFOs are responsible for functions outside of finance. Whether by focusing on strategic partnerships, evaluating technology, or working to meet revenue and earnings goals, CFOs are expected to be strategic catalysts of company growth — not just the head of the financial organization.[3]

Construction companies need to be ready to ramp up their digital initiatives to capture and make sense of the data, both financial and non-financial, that they will collect from varied sources. CFOs can play a vital role in establishing a proper data pipeline for collecting, storing, and analysing data.

Accenture has found that 76% of CFOs believe unifying disparate data is vital to achieving business objectives.[4] So, CFOs of construction companies will find themselves responsible for removing financial data disparity in the organization to establish the single truth throughout the organisation.

CFOs will also have to be able to introduce agility in their financial planning using tools that will allow them to adapt to the market by creating models which predict the real-time changes in the market. The construction companies can’t become agile by planning 12 months in advance. That means the whole industry will have to start moving away from fixed-price contracts.

CFOs are declaring war on spreadsheets

They have decided they need smarter, quicker, decision-makers if they are going to snatch the right deals. That means the data needs to be current and accurate. Unifying data for analysis eliminates the need to pull it in from disconnected databases and spreadsheets. At the same time, a single source of data also increases the speed of reporting and reduces the inefficiency and errors inherent in manual processes.

“It took so long to build the forecast in Excel that the opportunity has been and gone.”

“If we knew that 30 days ago, we could have done something about it.”

A separate study by DataRails found that 70% of CFOs rely on Excel for financial budgeting and forecasting.[5]

What you need is a platform that is able to absorb internal and external data, and the forecasts made by your frontline people. It will need to bring this together into neat and tidy reports your executives can read to make decisions at speed.

In other words, this group is solving the data disparity within their organization by reaching for a single platform to become the source of truth.

According to NetSuite Brainyard’s white paper, “State of the CFO Role,” 186 CFOs respondents said they spend an average of 2 hours in spreadsheets every day. That’s more time in spreadsheets than any other software in their toolkit.[6]

CFOs are removing data disparity

The primary goal for CFOs in the construction industry is to find a solution that can remove data disparity, that can be rapidly deployed in a lean form and that can be scaled to benefit from the investment in such a solution. Amendra says:

“The roles of CFOs are changing from being the numbers people to being more and more of a trusted advisor of which direction a company is going to go in terms of financial transformation. Their advisory needs to be based on data and reality instead of a gut feeling.”

CFOs are adopting driver-based forecasting

Driver-based forecasting uses the key levers or drivers in your business to help you evaluate the impact of internal or external changes. Forecasting P+L and balance sheets based on actuals and historical data is proving less reliable. In the Australian construction industry alone, market conditions have moved so quickly in the last 24 months, that history can no longer be trusted to tell the future.

Start your financial transformation

Talk to us about your planning and analytics and let's see if we can help.

In a recent project with a leading media company in Australia, we set out to demonstrate how IBM Watsonx Orchestrate can revolutionise finance operations through the power of Generative AI. The Commercial Finance team, under constant pressure to deliver timely, accurate and insight-rich reports, needed a smarter way to move beyond manual data wrangling and deliver executive-ready outputs in record time.

.png?width=530&height=304&name=Alan%20blog%20(1).png)

That’s where WatsonX Orchestrate came in. Unlike traditional BI or workflow automation tools, Watsonx Orchestrate leverages Generative AI to not only automate repetitive tasks but also to interpret, contextualise and generate meaningful outputs. The result is a system that empowers both analysts and executives to act faster, with confidence, while minimising human bottlenecks.

Automating Financial Report Generation

Key Capabilities:

-

Automated extraction, transformation and loading (ETL) of data from a data warehouse.

-

Automated generation of third-party and monthly executive summary reports.

-

AI-driven identification of key events influencing financial outcomes.

-

Analyst verification loop to ensure accuracy and compliance.

Business Impact:

-

Reports created in minutes rather than weeks.

-

Reduced data duplication and inconsistencies.

-

Analysts free to focus on high-value strategic analysis.

-

Executives receive timely, validated insights for faster decision-making.

Self-Service Financial Insights

Key Capabilities:

-

A bespoke AskFinance portal enabling natural language queries.

-

Secure access aligned with role-based permissions.

-

Pre-trained CFO scenarios to simulate executive decision contexts.

-

Integrated visualization tools for interactive reporting.

Business Impact:

-

Executives gain independence in accessing financial data.

-

Real-time insights without reliance on BI analysts.

-

Streamlined reporting across departments and report types.

-

Forecasting and scenario modeling made simple, accurate and quick.

Use Cases in Action

Producing Monthly YTD Monetisation Reports: Automating the calculations behind key metrics, seamless PowerPoint slide generation, clean, consistent reporting outputs in a standardised format.

Delivering Monetisation Insights: Automated chart creation and AI-driven callouts, generative commentary highlighting anomalies or areas needing attention, a natural language interface to query insights and commentary directly.

Tangible Benefits

-

~60% ROI: Analysts reallocated to higher-value activities, reducing attrition costs.

-

~99% efficiency gains: Manual reporting reduced to near-zero.

-

2 weeks → 10 minutes: End-to-end report creation compressed dramatically.

-

Improved data quality: Automated reconciliation reduces inconsistencies and errors.

-

Scalability: Built to handle larger datasets and evolving financial needs.

Beyond Media: Industry Relevance

The use case resonates strongly across industries, such as airlines, where BI Analysts and Finance teams spend significant time manually preparing and reconciling data. In one example, reliance on IBM Planning Analytics was slowing executive decision-making as stakeholders had to wait for analysts to deliver real-time data insights.

Watsonx Orchestrate bridges this gap by delivering:

Automation of complex financial workflows.

Generative insights at scale.

Democratisation of access to financial intelligence.

Curious how Agentic AI could reshape your finance operations? Let’s start a conversation tailored to your requirements.

Warning: long term use of Excel is lethal for CFOs trying to make data-driven decision-making. Discover how Excel can’t excel when it comes to managing data and what can be done about it.

The troubles with Excel are only beginning. Excel not only caps out at a million records, but it also rounds off large numbers using imprecise calculations which compromises the accuracy of your data.

Excel is a single-user system. That means it only allows one person to input data at a time. There’s a high chance that someone entering the data does it without regard for storage, backup, and processing best practices.

Excel kills collaboration

They lack IT expertise, so they hyper-personalise it for themselves leaving no room for collaboration and control.

Working with real-time data in such an environment where there is no room for collaboration and control becomes cumbersome and time-consuming. Your employees are spending their valuable time putting together different versions of data that are scattered over different workstations in different departments.

No integration with other finance systems

Excel cannot be integrated with data from other departments to get insights and make decisions. This creates a situation where finance managers don’t have consistent visibility of data throughout the operations.

When you operate in different locations throughout Australia, the only way to share such files is through emails. Different versions of your data are flying around back and forth with different versions of truth in them. Anyone who tries to alter logic can do so without any accountability.

Excel inaccuracies go undetected

Missing data and incorrect formulas introduced by human errors can easily be propagated throughout your organisation because of the links in the worksheets. The links tend to break creating a cyclic version control nightmare that is very difficult to troubleshoot. Even if someone can get all the files together, it becomes impossible to trace the logic behind the personalised formulas that only the creator could understand. If the creator of the file is not available or has left your organisation, everything comes to a halt.

Anthony, head of Client Relations at Octane, tells this story about a CFO from the construction industry, who is moving away from Excel to a modern budgeting and forecasting tool:

“They wrote their excel sheets over a period of 15 years. No one knows where the person who started writing it is today. The logic is buried so deep inside the excel spreadsheets that it breaks very easily. When other people make calls to such links it breaks everything and now nobody knows what to do next.

Worse, people often have to input their numbers in a sequence. If Jack doesn’t enter X, then Jill cannot enter Y. It’s a joke that is played out in finance offices all over Australia.”

Excel attracts malicious behavior

Intentional and fraudulent manipulations are very easy to do with Excel. The company files with financial logic into it should never fall into the wrong hands. But with Excel, your data can be easily copied and updated with faulty values and dependencies without being detected.

Further, in case of any mishap or disaster, there is no way for full data recovery with Excel. Without the company’s financial data, customer records, inventory data, and sub-contractors' accounts it becomes very hard for the company to make a quick turnaround after such events.

Missing regulatory deadlines

Consolidation of data to prepare reports while cross-referencing it with different versions from different departments takes a lot of time and effort from your employees. A lot of times your executives can even miss the timelines for a proper course of action.

Meeting regulatory compliance from the Australian government is a very good example of how things can go downhill with Excel. The Australian government is tightening regulations and you would have a timeline to meet while submitting your worksheets. There’s a high chance that your spreadsheets will take a lot more time and effort to put together missing the deadlines and exposing you to official scrutiny.

CFOs still love Excel

Excel is not going away. Despite the pitfalls, Excel remains best friends with CFOs. According to NetSuite Brainyard’s whitepaper, CFOs spend an average of 2 hours in spreadsheets every day. That’s more time in spreadsheets than any other software in their toolkit. [1]

TM1: a modern budgeting and forecasting tool that uses Excel

Most finance people will keep using Excel because they have grown with excel sheets. Even when they face all these problems with Excel, they simply can’t get over the user interface and the flexibility that Excel provides.

That’s why TM1 was developed by IBM. It is a modern budgeting and forecasting tool that still uses an Excel interface.

- TM1 allows the finance office to pull and manipulate millions of records in less than a second using a familiar Microsoft Excel interface.

- TM1 has all the flexibility of Excel like writing formulas on the fly, without the inaccuracies of Excel.

Amendra Pratap, Managing Director at Octane, says:

“In spreadsheets, you cannot form a repeatable and reliable process. Every time you do something, you must do it over and over again. You can’t perform to your fullest potential when your employees are doing process work. Platforms like IBM Planning Analytics then eliminate the repetition of effort, freeing your managers to do the job that needs their actual attention.”

Instead of using historical sales data, CFOs making financial transformations are shifting to driver-based forecasting. In the Australian construction industry alone, market conditions have moved so quickly in the last 24 months, that history can no longer be trusted to tell the future.

In the Australian construction industry alone, market conditions have moved so quickly in the last 24 months, that history can no longer be trusted to tell the future.

Forecasting P+L and balance sheets based on actuals and historical data is proving less reliable. The historical data can’t capture the market dynamics like real-time data can and forecasts based on historical data don’t give good indicators for the decision-making processes. Driver-based forecasting models are going to replace the models based on historical trends for budgeting and forecasting. Anthony Coundouris, Head of Client Relations are Octane says:

“Historical data can’t be a good determinant for the forecasting because the pace of change from one increment to the next is so great, that by the time the data is recorded, the opportunity or the threat is gone. With driver-based forecasting, you can build, and export different forecasts based on what-if scenarios.”

What is driver-based forecasting?

Anthony says:

“There is a huge opportunity for these guys to pick up projects from failing construction companies. However, the question remains: which ones are good and which ones are duds?”

Driver-based forecasting uses the key levers or drivers in your business to help you evaluate the impact of internal or external changes. Let’s take an example of acquisitions of construction projects. The predictive models can break down costs for each job and determine the profitability to help you discern which projects to acquire.

Billables are another important driver. Billing data on market rates help you forecast your payables and receivables. Billing analytics can help establish efficient accounting that is free from duplicate invoices, disputes, and gaps in price margins. A very good example would be equipment costs. It doesn’t matter if you are buying or renting the equipment, the forecasts based on the traditional approach miss by as much as 40%. Leveraging forecasts from real-time data can easily mitigate such over or underestimation.

Amendra warns:

“Companies need to have the tools and data at their fingertips to allow themselves to be able to see the insights by performing what-if scenarios on drivers to optimise their cost base and their funding arrangements with their banks and financial institutions.”

Driver-based forecasting needs a lot of data

The sources of data will be varied. Ranging from the financial data from the suppliers, contractors, and other participants in your network to the data that your ERP platform collects from the operations and forecasts inside your own organisation.

On top of that, non-financial data like weather patterns, market data that captures the shift in costs of materials, interest rates, inflation, labour force, and Government policy along with safety data, waste data, and workflow data that directly or indirectly contribute to the financial decisions and forecasting will increase the total volume of data that your organization needs to capture.

Excel won’t cut it

Some construction companies are still trying to rely on manual methods like spreadsheets. But Excel has limitations. First, it has a hard stop at a million records. We can’t expect Excel to deal with such varied sources of data in real-time with millions of records when it can’t even deal with the company’s own full history of actuals.

Secondly, it’s impossible to collaborate and maintain a single truth across the whole organisation using spreadsheets. Even if you try to maintain huge volumes of real-time data in Excel, it easily breaks when you try to link the logic.

Anthony says:

“CFOs tell the same story of how they came across the forecasts from inefficient spreadsheets that took too long to put together. They say if only they could have known about it 30 days ago, they could have taken evasive actions.”

Don’t sweat it. This is easier than you think.

So there has to be a way to unify data and maintain a single source of truth for analysis eliminating the need to pull it from the disconnected databases and spreadsheets. Such a platform will enable your company to absorb internal and external data increasing the speed of reporting while reducing errors and inefficiencies involved in the manual processes.

Anthony remains optimistic:

“We don’t want you to be afraid of the huge amount of data. Embrace all the data that comes from your internal departments and from external sources. But don’t be restricted by Excel because it simply lacks the agility and dexterity to crunch the big data that’s going to be in your hands soon. TM1 can bring millions and millions of records from your historical and real-time data sources like a snack in a matter of milliseconds.”

Accurate forecasts and reports from IBM TM1 Planning Analytics add agility, speed, and accuracy to thrive during and after disruptions in the industry. Forecasts based on real-time data can mitigate your risk by detecting triggers and optimizing the costs to improve your profitability while you develop your rate models and enter negotiations for competitive proposals.

Amendra concludes:

“In fact, most construction companies can achieve driver-based forecasting in eight weeks and for less than A$80,000. I’m surprised not more of them are shifting.”

Home Innovation Builders, Dyldam Developments, Hotondo Homes franchise, Tasmanian Constructions, ABD Group, BA Murphy, Pindan, and Inside Out Construction have all gone bust. It’s time CFOs from the construction embraced financial transformation.

Construction giants like Probuild and Condev have collapsed. Many other construction companies are looking at downturns and the huge debt that’ll push them into a similar path to liquidation. Amendra Pratap, Managing Director at Octane, say:

“The rate of construction companies falling and going bankrupt is at an all-time high. The major reason behind such downfalls is the rise in the cost of operation and construction materials.”

The construction sector inflation will hit 6% over the year till December 2022 according to a report by Macromonitor. Matthew Mackey, executive director of engineering company Arcadis, told Daily Mail Australia: [1]

“I don't think a lot of companies are taking the cost increases seriously. It's a perfect storm”,

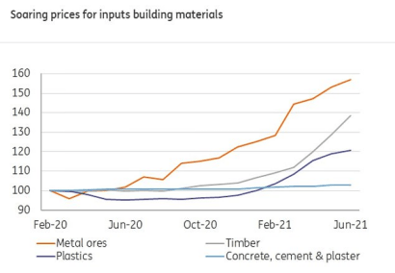

The market has become highly volatile. Even after the supply chains have become responsive, the material costs and commodity prices are shooting through the roof. Industry bodies have reported soaring timber prices by 50% to 100% in 2021. Steel has gone up between 30% to 60%. Similarly, concrete has gone up by 20% to 40%. Moscow’s war in Ukraine has also affected engineered timber products coming into Australia from Russia which added a further 25% price increase this year. Delays on other manufactured products, such as roof trusses, glass, and steel are also extending the time it takes to deliver projects and pushing up costs for the contractors. [2]

While companies try to manage big orders, they are struggling because they have locked themselves into agreements prior to the rise in costs.

Building materials graph

Building materials graph

“Fixed price contracts have brought down most of these builders as it makes them have no ability to pass on cost increases on timber and steel accounting”,

said Paul Bidwell, Master Builders Queensland deputy chief executive.[3] Adam Merlehan at SmartCompany quite appropriately pointed out that the construction industry is besieged by a profitless boom. Amendra says:

“When construction companies signed a contract for 6 months they didn’t take into account the sheer rise in the price of the materials and now it has left them exposed to a high cost and a thin profit margin. But legally they couldn’t raise the price and that’s why the deals automatically collapse.”

Thin profit graph

CFOs think the glass is half full

According to AFR, Australian CFOs are feeling optimistic about the prospects for their companies in 2022.[4]Deloitte in 2022 reported that over 80% of the country’s senior finance executives feel optimistic about the prospects for their company over the next 12 months. Deloitte partner, and CFO Program leader, Stephen Gustafson said:

“CFOs have acclimatised to tumultuous times, and with more confidence comes a greater appetite for risk. 41% of CFOs think they are under-geared, and 66% agree that now is a good time to be taking greater risk onto their balance sheets, up from 53% six months ago.”[5]

Now is the time to capitalise on the change.

Transform or die trying

Andrew Spring, partner at building insolvency specialist Jirsch Sutherland said:

"I wonder whether, off the back of this, we may need to see a reset in the industry as to how they go about pricing for work and assessing how to deal with these types of really rapid, difficult fluctuations." [6]

Andrew’s comments could not be further from the truth. Low profits, stagnant growth, and a huge dive into customer satisfaction have created a dire need for financial transformation in the industry.

We expect the consolidation in the construction industry to rapidly transform the whole industry in the next two years. At the end of this intense reshuffling, there’ll only be three types of companies left:

- The group who does not survive at all

- The group who survives – the majority

- The group that thrives by seizing the opportunity

Amendra is quick to make the distinction and says:

“The quicker you evolve and the quicker you transform your department and your company into an entity that is smarter and makes data-based decisions, you’ll have a clear pathway to joining the list of companies that will be thriving.”

The companies that will thrive due to the financial transformation will be able to buy out all the collapsing deals and come out of this stronger than ever. Equipped with the right financial tools, they can separate the gems from the weeds in terms of deals they consider.

Financial transformation will not only help construction companies have greater control over their value chain but also help them take the leap toward data-driven decision-making.

Manufacturing learnt their lesson long ago

The construction industry is not the first industry to encounter such disruption. Lessons can be drawn from other industries with similar attributes that went through similar disruptions. In the manufacturing industry, many players who thrived during and after the disruption were the ones who adopted digital and cloud-based solutions. As we discussed above, the same will happen for construction companies, the winning players will soon adopt cloud-based solutions.

Financial transformation in construction has begun

As of now, it has started from the integrated production and distribution of electronic documents. An increasing number of suppliers and contractors are making heavy use of mobile apps to perform tasks while collecting, storing, and segmenting data to analyse, forecast, and fix productivity gaps in their projects and inefficiencies in their organisational health.

Contractors have realized the benefits of having real-time information on their hands to make critical forecasting and decisions. It not only provides them with a single source of truth for operations in their organization but also peace of mind because they have the backups in their cloud. Improvements in the ability to gather and analyse data will follow with the advancement of mobile and cloud technologies that make it possible to pull data from real-time sources.

A cost-benefit analysis is key to financial transformation

Anthony Coundouris, Head of Client Relations at Octane, recommends that companies not jump too quickly into buying software. He says:

“You need to build a business case first. What it will cost and what it will return. CFOs who can do this stand a much higher chance of getting the organisation to buy in to financial transformation”.

Dexter Clarke, CFO of vehicle servicing company Motorserve, suggests other CFOs spend substantial time upfront understanding and mapping processes. He says:

“You need to do the work upfront to understand existing processes. If you don’t do that, don’t think a different system will give you an improved process. You’ve got to improve the process and understand where the waste is before you start talking to software vendors." [7]

we go the extra mile so you can go the distance|

Got a question? Shoot!

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

.png)

.webp)

.png?width=673&height=371&name=IBM_Gold-removebg-preview%20(1).png)

Leave a comment