We are standing at the threshold of the most significant transformation in finance since the invention of the spreadsheet. Artificial Intelligence isn’t a future concept — it’s here — quietly rewriting how finance teams plan, decide, and perform. And yet, despite the global AI boom, 95% of enterprise AI initiatives fail to deliver measurable impact. Not because the technology falls short, but ...

- The CFO's AI Playbook : From Ah-Ha to Acceleration

- IBM Project Bob: The Beginning of Enterprise-Grade Agentic Software Development

- The Three Mistakes That Kill Enterprise AI

- What's new in Cognos Analytics 12.1.x

- Agentic AI in Finance & TM1: Why Everyone’s Suddenly Talking About It

- Octane’s AI Contract Analyser & Ask Procurement Portal: Transforming Contract Review for Modern Enterprises

We are standing at the threshold of the most significant transformation in finance since the invention of the spreadsheet. Artificial Intelligence isn’t a future concept — it’s here — quietly rewriting how finance teams plan, decide, and perform.

And yet, despite the global AI boom, 95% of enterprise AI initiatives fail to deliver measurable impact. Not because the technology falls short, but because most organisations stop too soon. They automate tasks but never redesign the system.

At Octane Solutions, we’ve worked with over 100 finance teams across APAC — and we’ve seen what separates the few that scale from the many that stall. The secret is simple but profound: structure before scale.

From Industrial Revolution to Intelligent Finance

When electricity first arrived in the 19th century, factories did what seemed logical — they replaced gas lamps with electric bulbs. Workplaces became brighter and safer, but not smarter. The true revolution began when they redesigned entire production lines around electric motors, unleashing a new era of efficiency and innovation.

Finance today stands at a similar crossroads.

Chatbots, copilots, and summarisation apps are our lightbulbs — illuminating the potential of AI but not transforming how work gets done. The real breakthrough will come with Agentic AI — a new generation of intelligent systems that reason, coordinate, and act autonomously across the finance ecosystem.

Agentic AI doesn’t just automate; it orchestrates. It doesn’t replace people; it amplifies them. And for the CFO, that means the finance function can finally shift from explaining the past to predicting — and shaping — the future.

The CFO’s Challenge: Insight at the Speed of Business

CFOs today face a dual reality:

- The demand for immediacy: real-time forecasting, continuous scenario analysis, and rolling insights.

- The constraint of legacy: manual reconciliations, fragmented data, and static planning cycles.

Most finance teams have automated fragments of their process — but not the process itself. Reporting is faster, but not necessarily smarter. True transformation happens only when AI becomes part of the fabric of finance — not an add-on.

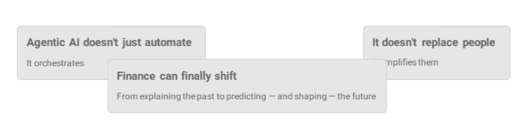

Below are 6 opportunities now emerging as AI evolves from simple LLMs to self-governing, multi-agent ecosystems:

- Conversational analytics and natural-language access to financial data. Finance teams can now ask a question — “What’s our EBITDA variance this quarter?” — and receive a fully contextualised, narrative answer drawn from live systems.

By eliminating manual report preparation, CFOs gain faster clarity and sharper storytelling for stakeholders.

Impact: 80% reduction in analyst report-prep time and faster decision support across FP&A.

- AI that reads, reconciles, and extracts insight from financial documents, PDFs, and spreadsheets.

An airline company uses AI agents linked to Planning Analytics and Excel sources to generate reconciled financial reports in 10 minutes instead of two weeks.

Impact: Continuous visibility into financial performance, replacing static monthly reporting with real-time oversight.

- AI with direct access to corporate databases, enabling dynamic analysis. For a Media company, Octane’s “AskFinance” agent combined data from TM1, Adobe Analytics, and Google Ad Manager to generate contextual financial commentary in seconds.

Impact: 80% reduction in report-generation cost and 98% faster access to narrative insights — AI that doesn’t just calculate but explains why.

- AI that integrates across finance platforms — TM1, SAP, Concur, ERP, and APIs — to coordinate entire workflows. Through Watsonx Orchestrate, CFOs can now automate the entire chain from forecasting to variance reporting: “Generate a cashflow forecast and alert me if OPEX exceeds budget by 5%.” AI handles retrieval, validation, and communication autonomously.

Impact: 99% reduction in manual reporting cycles; faster consolidation, real-time alerts, and seamless cross-system collaboration. - Autonomous decision-making within governed boundaries. AI agents now detect anomalies, recommend journal adjustments, and monitor exceptions before they escalate. This allows finance functions to move from reactive close cycles to proactive exception management.

Impact: Predictive close cycles, risk reduction, and up to 60% ROI in the first 12 months of deployment.

- Safe, transparent, multi-agent ecosystems that manage entire finance functions. Each agent — whether a “forecast bot,” “audit bot,” or “reporting bot” — operates under strict governance, with auditability, explainability, and regulatory alignment. Octane’s enterprise rollout playbook embeds SOC2, GDPR, and financial reporting controls into every workflow.

Impact: Full audit traceability, regulator-ready documentation, and scalable, trusted AI adoption.

The CFO’s now need to realise that their goal is no longer to add another digital assistant, but to build an ecosystem of intelligent, responsible, and explainable agents that make finance self-improving. This shift isn’t about hype or replacing people. It’s about constructing a resilient, data-driven finance engine that learns, adapts, and optimises continuously — from planning to forecasting to audit.

Agentic AI marks the true turning point of the finance— moving beyond automation to orchestration, where decisions are made faster, risks are mitigated earlier, and value is created intelligently.

The 9 Principles Behind Successful AI Transformation

Through 100+ modernisation projects, Octane has distilled nine practices that consistently deliver value:

1. Align AI to Business Impact – Focus on measurable outcomes, not pilots.

2. Build a Finance AI Centre of Excellence – Unite Finance, IT, and Operations under a single vision.

3. Invest in Skills, Not Just Software – Equip people to interpret, question, and guide AI.

4. Adopt Adaptive Governance – Control risk without stifling innovation.

5. Prioritise Data Quality – No AI can outperform bad data.

6. Start with Use Cases – Identify problems before choosing platforms.

7. Automate the Mundane – Free people for creative and strategic work.

8. Measure by Business Outcomes – Look beyond cost savings to agility, accuracy, and trust.

9. Scale Proven Success – Replicate what works across divisions.

Transformation begins with clarity, not complexity.The Foundation of Trust and Scale: IBM

AI’s potential means nothing without trust. That’s why Octane’s partnership with IBM is central to every finance transformation journey.

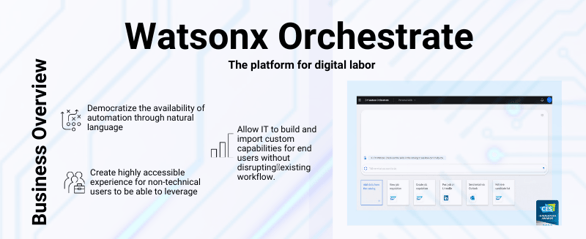

Built on IBM’s Agentic AI Platform this foundation ensures that CFOs can modernise with confidence — embedding explainability, governance, and measurable ROI from day one. IBM’s Watsonx Orchestrate (Agentic AI Platform) is a key enabler. It uses intelligent digital workers to automate complex workflows, from reconciliations to board-pack creation. With embedded governance, it’s designed to keep humans in control while machines handle the heavy lifting.

Explore: IBM Watsonx Orchestrate →

Agentic AI: From Automation to Orchestration

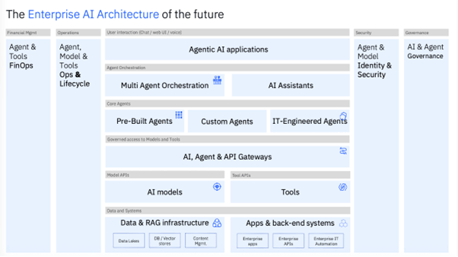

IBM’s Agentic AI Frameworks mark a shift from tools to systems — from automating tasks to orchestrating end-to-end business outcomes.

They include:

-

Agent Development Lifecycle (ADLC): The governance backbone for building responsible agents.

-

Model Context Protocol (MCP): A transparent standard for open, explainable AI.

-

Hybrid-First Architecture: Ensures flexibility across cloud, on-prem, and edge.

This architecture doesn’t just make AI smarter — it makes it sustainable.

Learn more: Agentic AI Frameworks →

Anthropic + IBM: Responsible AI for Regulated Finance

IBM’s partnership with Anthropic brings the Claude family of models into the Watsonx ecosystem — marrying safety and sophistication.

This enables CFOs to deploy AI assistants that:

- Generate narrative financial reports in natural language.

- Automate forecasting and scenario modelling.

- Support reconciliations and anomaly detection within governed environments.

It’s AI that works like a trusted analyst — intelligent, auditable, and always under your control.

Read more: IBM–Anthropic Partnership →

Groq + IBM: Redefining Speed and Efficiency

AI adoption often stalls on cost and latency. Groq changes that.

By integrating Groq’s high-speed LPU architecture into Watsonx Orchestrate, IBM delivers 5× faster inference and 80% lower compute cost — without compromising security.

This is the infrastructure that turns AI pilots into production systems.

Octane + IBM: The Partnership That Delivers

Octane’s partnership with IBM isn’t symbolic — it’s operational. Our IBM Champions work hand-in-hand with IBM’s product and engineering teams to co-create real-world use cases for finance.

From FP&A to supply chain modelling, Octane helps clients deploy AI-ready cubes, design agentic workflows, and establish continuous improvement frameworks that evolve with business needs.

Our Global support models — Octane Black and Octane Blue — offer CFOs flexible, SLA-backed coverage that reduces total cost of ownership by up to 35%.

AI success isn’t about pilots — it’s about discipline, design, and delivery.

summary, The Cognitive Finance Function- The finance team of the future will not just report performance — it will anticipate, optimise, and advise.

It will be:

- Predictive, not reactive.

- Autonomous, not manual.

- Augmented, not overloaded.

- Connected, not siloed.

- Trusted, not opaque.

This is The Cognitive Finance Function — powered by AI, governed by design, and aligned with enterprise strategy.

What Next?

AI in finance isn’t about technology — it’s about transformation. The winners will be those who move beyond experiments to execution, designing their finance operations for intelligence, not just automation. As we head towards 2026, it's vital that your finance strategic plans are set and able to be easily communicated for impact.

Octane and IBM are helping CFOs make that leap — securely, measurably, and fast.

Book a strategy session with Octane to explore your AI-in-Finance roadmap and we’ll walk you through the below practical Roadmap to Building an Intelligent Finance Function

Sign up for a 30-day free

Diagnose — Identify Where AI Can Create Meaningful Impact

Design — Combine Orchestration with Human Judgment

Deploy — Start Small, Prove Fast, Scale Wisely

Demonstrate — Quantify ROI and Institutionalise Learnings

Differentiate — Make Finance the Intelligent Core of the Enterprise

Final Thought: From Lightbulb to Lighthouse

The future of finance belongs to leaders who don’t just turn on AI — they design for it. CFOs who embed intelligence, governance, and agility into their finance DNA will redefine how value is created and measured

Why IBM’s AI IDE matters for regulated enterprises, modernisation programs, and developer productivity.

.jpeg?width=355&height=358&name=cq5dam.web.1280.1280%20(1).jpeg)

Introduction

Enterprise software development is under pressure from every direction: modernisation mandates, cloud migration timelines, rising cybersecurity threats, and persistent talent shortages. At the same time, the systems that run the world—banking platforms, government services, supply chain systems, healthcare records, and airline operations—are often built on decades of accumulated code, tools, and operational processes. This creates a productivity and risk gap that conventional development approaches struggle to close.

Generative AI has already proven it can boost developer productivity. But most first-wave tools were optimised for individual developers and public code patterns, not for enterprise realities like regulated environments, legacy platforms, strict governance, and long-life applications. This is where IBM’s Project Bob enters the conversation.

Project Bob is IBM’s vision of an AI-native, enterprise-grade development environment—an AI-powered IDE designed to help teams build, understand, modernise, secure, test, and deliver software with governance baked in. It is not simply “autocomplete on steroids.” It aims to act more like an AI teammate that understands enterprise constraints and can coordinate multiple specialised capabilities to complete real engineering outcomes.

1. The Enterprise Software Development Crunch

To appreciate why IBM is investing in Project Bob, it helps to understand the structural pressures enterprises face today.

First, there is the burden of legacy. Large organisations rarely get to “greenfield” major systems. They build on top of existing platforms—mainframes, long-lived databases, proprietary middleware, and monoliths that have been continuously modified for years. Over time, complexity accumulates: business rules get embedded in obscure places, integration points multiply, and documentation falls behind reality.

Second, talent is increasingly scarce. Many legacy technologies depend on experts who are retiring, while newer engineers prefer modern stacks. Even in modern environments, it is hard to retain institutional knowledge across reorganisations, acquisitions, and vendor changes. The result is a growing gap between the code an enterprise runs and the number of people who can confidently change it.

Third, regulation and operational risk change the game. A consumer application can ship quickly and iterate. A bank, insurer, healthcare provider, or government agency cannot. There are compliance obligations, audit trails, change management processes, and security controls that must be satisfied every time software is modified. In these environments, the cost of a defect, vulnerability, or compliance failure is far higher than the cost of moving slowly.

Finally, demand for digital change continues to accelerate. Enterprises are expected to deliver better customer experiences, integrate AI capabilities, modernise infrastructure, and meet new cybersecurity standards—often simultaneously. Development teams are asked to deliver more, faster, with fewer people, on more complex systems, under tighter constraints.

This is the reality: enterprises need a step-change in how software engineering work is executed—without sacrificing governance, safety, or compliance.

2. What Project Bob Is (And What It Isn’t)

Project Bob is best understood as IBM’s attempt to reimagine the developer environment for enterprise AI. The goal is not to replace developers; it is to shift developers upward toward intent, architecture, and decision-making, while AI takes on a larger share of the mechanical work.

In practice, Project Bob is described as an AI-powered IDE and development assistant that can support coding tasks, modernisation activities, debugging, documentation, testing, security, and operational readiness. The emphasis is important: enterprises do not just need code generation. They need an environment where generated or modified code is aligned to standards, verifiable, and auditable.

Project Bob is not the same thing as a chat interface that happens to generate code. It is positioned as a development environment where AI is embedded into the workflow—so that analysis, refactoring, tests, vulnerability checks, and documentation can be triggered as part of completing a task, not as separate afterthought steps.

This matters because most development time in the enterprise is not spent writing novel algorithms. It is spent understanding existing behaviour, navigating dependencies, adapting interfaces, complying with security requirements, writing tests, updating documentation, coordinating releases, and keeping systems stable.

Project Bob aims to accelerate the full software lifecycle, not just code output.

3. Why “Copilot-Style” Tools Are Often Insufficient for Enterprises

One of the most significant ideas behind Project Bob is the move toward agentic workflows. Instead of treating AI as a single assistant that responds to prompts, an agentic system breaks work into multiple steps and coordinates specialised capabilities to produce outcomes.

In software engineering, a meaningful task often requires more than a code snippet. Consider a typical enterprise change request: “Add a new validation rule to the billing system, update downstream interfaces, ensure backward compatibility, and ship with test coverage and security validation.” This touches multiple components and needs verification.

In an agentic model, completing the request could involve:

-

An analysis step to identify where the business rule belongs and what it affects.

-

A code modification step to implement the change.

-

A test generation step to create unit, integration, and regression tests.

-

A security step to scan for vulnerabilities or insecure dependencies.

-

A documentation step to update runbooks or design notes.

-

A pipeline step to ensure CI/CD changes are aligned.

-

A review step that summarizes the change and highlights risk areas.

Project Bob’s value proposition is that it can help coordinate these activities in a structured way—reducing the overhead of “engineering glue work” that consumes significant time in enterprise teams.

5. Modernisation: The Highest-Value Enterprise Use Case

Modernisation is where an enterprise-focused AI development platform can create an outsized impact. Legacy modernisation is rarely a single migration. It is a portfolio of initiatives: upgrading Java versions, replacing deprecated frameworks, decomposing monoliths, exposing APIs, improving observability, and migrating workloads to cloud or container platforms.

Modernisation often fails for predictable reasons: teams cannot fully understand the existing system, regression risk is high, testing is incomplete, and the number of dependencies is overwhelming. Even when the migration target is clear, the path is uncertain.

AI changes the economics of understanding and transforming existing systems. A well-integrated AI development environment can accelerate:

-

Code comprehension: explaining modules, dependencies, and business logic.

-

Refactoring: converting patterns, replacing deprecated APIs, and restructuring components.

-

Migration guidance: suggesting upgrade paths and compatibility fixes.

-

Test generation: producing coverage that reduces regression risk.

-

Documentation: creating maintainable reference materials for future teams.

IBM has a long history of modernisation projects across mainframe, middleware, and enterprise stacks. Project Bob can be seen as a productisation of what modernisation teams have always needed: faster comprehension and safer transformation at scale.

6. Security and Compliance as Built-In Workflows

Security is not optional in enterprise development. It is also not “a tool you run at the end.” Modern development organisations aim to shift security left—catching issues early when they are cheaper to fix.

For AI-assisted development, security becomes even more important. If an AI tool accelerates code changes, it must also accelerate safe changes. Otherwise, it increases risk.

An enterprise-grade AI development platform should support:

-

Dependency and vulnerability scanning.

-

Secure coding guidance in context.

-

Detection of insecure patterns (hardcoded secrets, weak crypto, injection risks).

-

License and policy checks.

-

Traceability of changes and the rationale behind them.

Project Bob is positioned to incorporate these capabilities directly into the development environment so that teams can validate security and compliance during implementation, not after a release candidate is already assembled.

7. “Intent-Driven” Development and the Business Impact

The most transformative shift in AI-assisted development is the move from syntax-driven work to intent-driven work.

In a syntax-driven world, engineers spend time implementing routine patterns: controllers, serializers, validation layers, database queries, caching, logging, and tests. Much of this is predictable. The scarce part is not the keystrokes—it is the correct intent: what should the system do, under what constraints, and with what risk posture?

In an intent-driven environment, a developer can specify outcomes such as:

-

“Create an endpoint to retrieve customers by region, with caching and role-based access control.”

-

“Refactor this service to remove deprecated dependencies and improve test coverage.”

-

“Generate a migration plan from Java 8 to Java 17 for this module.”

The business impact is direct:

-

Shorter delivery cycles for standard features.

-

Faster modernisation timelines.

-

Better continuity when key engineers leave.

-

More consistent adherence to enterprise standards.

-

Reduced risk through integrated testing and security validation.

This changes how organisations plan. Instead of building teams around manual implementation capacity, they can focus teams on architecture, business alignment, and risk management—areas where human judgment is most valuable.

8. Where Project Bob Fits in IBM’s Broader AI Strategy

Project Bob also makes sense in the context of IBM’s broader AI portfolio. IBM’s strategic positioning in enterprise AI is anchored on three pillars: models, data/governance, and execution.

At a high level:

-

Foundation models and AI capabilities enable reasoning and generation.

-

Data and governance ensure enterprise control, auditability, and trust.

-

Orchestration platforms turn AI into repeatable workflows and outcomes.

Project Bob extends this philosophy into software engineering. It aims to bring governance and enterprise controls into AI-assisted development, just as orchestration platforms bring structure into business automation.

For customers already invested in IBM’s ecosystem—OpenShift, mainframe modernisation, integration stacks—Project Bob can become a central developer experience layer that aligns with enterprise operational requirements.

9. Implications for Consulting and Delivery Organisations

For system integrators, consulting firms, and delivery teams, Project Bob represents a meaningful shift in how value is created.

The traditional delivery model relies heavily on implementation labour: more developers, more hours, more manual tasks. AI-native development changes this. Competitive advantage shifts toward:

-

Having the right architectures and patterns.

-

Knowing how to modernise safely.

-

Designing governance frameworks for AI-assisted delivery.

-

Building reusable accelerators and reference implementations.

-

Creating robust testing, security, and release practices.

In this model, teams can deliver outcomes faster, with fewer handoffs and less rework. That is particularly valuable in modernisation programs where speed must be balanced against risk.

The firms that succeed will be those that combine domain expertise with an AI-orchestrated engineering approach—turning modernisation and delivery into repeatable, governable execution rather than one-off heroic efforts.

10. The Future: Agentic Engineering at Scale

Project Bob points to a broader future: agentic engineering at scale. Over time, software teams will increasingly operate like this:

-

Humans define intent, architecture, and constraints.

-

AI performs analysis, implementation, and validation steps.

-

Humans review, approve, and steer.

This does not remove the need for engineers. It changes what engineers do. Developers will spend less time on repetitive implementation tasks and more time on:

-

Understanding business requirements.

-

Designing resilient systems.

-

Managing risk and security.

-

Reviewing changes for correctness and maintainability.

-

Improving platform capabilities and developer experience.

The organizations that adapt will build higher-quality systems faster. Those that don’t will find themselves outpaced—especially in modernization and digital transformation initiatives where time-to-value matters.

Conclusion

IBM Project Bob is best seen as a serious enterprise response to the AI development wave. It is not merely a productivity tool; it is a vision for how enterprise software can be developed, modernized, and governed when AI is integrated into the workflow itself.

For regulated enterprises, modernization programs, and complex portfolios, the promise is compelling: faster delivery, safer transformation, and a development environment that embeds security and compliance into daily engineering work.

The next era of software engineering will not be about who can type faster. It will be about who can translate intent into outcomes with the highest confidence, the lowest risk, and the strongest governance. Project Bob is IBM’s early statement that this future is arriving—enterprise-first.

Hard Lessons From 100+ Deployments Across IBM’s Ecosystem

What I Wish I Had Understood Earlier – by Steny Sebastian, Principal Data and AI Platforms

Over the past year, I have been deeply immersed in enterprise transformations. Not slideware. Not proofs of concept. Real systems operating in production across HR, finance, insurance, sales, and core operations.

Many of these lessons emerged through close collaboration with IBM Product Managers, IBM APAC Technical and Sales Leader, IBM Client Engineering, and Octane AI engineers. Working together on real delivery challenges, sharing perspectives, and building agentic AI systems in practice made this journey both demanding and genuinely exciting, and shaped the thinking reflected here.

What surprised me most was not how advanced the technology had become.

It was how frequently capable, well-funded, and highly motivated organisations still struggled to move AI beyond experimentation.

Across more than 100+ enterprise businesses and AI initiatives, the pattern became impossible to ignore. The organisations that faltered were no less ambitious or less intelligent.

They made the same three mistakes.

And I have made versions of all three myself.

If you are serious about deploying agentic AI that delivers measurable outcomes, these are the lessons enterprise reality teaches you quickly, and often the hard way.

The Reality Check Most AI Programs Avoid

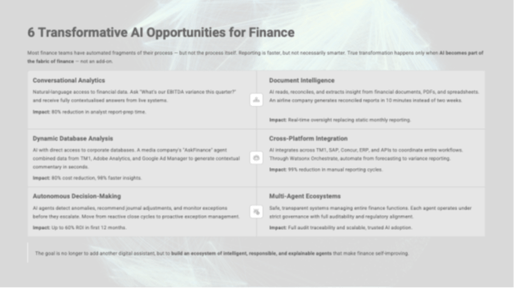

Most enterprises launch AI initiatives with genuine optimism. Boards approve funding. Executives champion innovation. Teams move quickly.

Then momentum quietly stalls.

Around 84 per cent of organisations are experimenting with GenAI. Only 26 per cent move into limited deployment. Just 10 per cent operate AI at scale.

This gap is not caused by a lack of models, tooling, or budget.

It is caused by an execution failure.

Due to unclear ownership.

By architectures that collapse under real-world complexity.

Agentic AI only succeeds when it is designed to run work, not just assist it.

The Three Mistakes That Kill Enterprise AI and the Rebuttals That Actually Work

Mistake #1: We Tried to Fix Everything at Once

❌ “Let’s automate the entire HR function.”

✔️ “Let’s fix resume screening first.”

This mistake is driven by optimism.

When leaders finally see what AI can do, narrowing the scope feels like underthinking the opportunity. Why fix one workflow when you could redesign the whole function?

Because the enterprise will not let you.

I have seen teams attempt to re-engineer entire functions in one move. HR. Finance. Customer Service. The result is always the same: architectural sprawl, unclear ownership, endless dependencies, and nothing that survives production scrutiny.

The rebuttal that changed outcomes:

Transformation starts with pain, not ambition.

Winning teams begin with one workflow that already hurts. One metric leadership already cares about. One process people are desperate to improve.

Resume screening. Invoice matching. Claims triage. Sales research.

Solve one problem properly, and something shifts. Trust replaces scepticism. Governance becomes concrete. A reusable agent pattern emerges.

Actionable takeaway:

If you cannot name the single workflow causing the most friction today, you are not ready to scale AI.

Mistake #2: We Hid Behind “Safe” Pilots

❌ “Let’s run a six-month pilot.”

✔️ “Let’s prove ROI in six weeks.”

Long pilots feel responsible. They buy time. They reduce political risk. They create the illusion of progress.

They also quietly kill urgency.

I have rarely seen a pilot longer than eight weeks make it to production. Executive attention drifts. Business priorities shift. Technical complexity compounds. The pilot becomes a science experiment no one wants to own.

The rebuttal that forced clarity:

Short pilots expose the truth.

Teams that shipped ran six-week pilots with success metrics defined on day one. Not model accuracy. Not technical elegance.

Business outcomes.

Cycle time reduction. Cost per transaction. Throughput improvement. Risk reduction.

Actionable takeaway:

If you cannot demonstrate tangible business value quickly, the problem is not the technology. The use case is not ready.

Mistake #3: We Waited for Perfect Data

❌ “We need to clean all our data first.”

✔️ “Let’s start with 80 per cent clean data.”

This mistake comes from fear.

No leader wants AI making decisions on imperfect data. Waiting feels prudent. Responsible. Defensible.

It is also fatal.

I have seen organisations spend years preparing data that never becomes “ready,” while competitors ship with imperfect inputs and improve in production.

The rebuttal that unlocked progress:

Data maturity follows value creation, not the other way around.

Agentic AI systems are designed to operate with imperfect information, provided guardrails, human oversight, and continuous learning are built in.

Actionable takeaway:

If data quality is the reason you have not started, you are already behind.

The Turning Point: From AI Assistance to Agentic Workflows

For years, many organisations have confused AI assistance with transformation.

Early-stage AI answered questions, drafted content, or suggested next steps. It looked impressive in isolation. But humans still carried the cognitive load, stitched outputs together, and managed exceptions manually.

The moment complexity increased, the system collapsed.

That is not scale.

That is augmentation with a ceiling.

True scale begins when organisations move from assistance to agentic workflows.

Agents generate near-final outputs. They coordinate subtasks across systems. They invoke tools. They apply policies. They escalate only when judgment is required.

At scale, more than 80 per cent of task execution can be handled by AI, while people retain accountability and decision authority.

This is how AI survives enterprise reality.

Why Architecture Determines Who Scales and Who Stalls

Agentic workflows only work if the architecture beneath them is open, modular, and governed.

This is why IBM Watsonx Orchestrate matters.

Rather than locking intelligence into a single model or assistant, watsonx Orchestrate is designed as an open orchestration layer for the enterprise AI stack.

It enables:

-

Multi-agent orchestration across complex workflows

-

Pre-built, custom, and IT-engineered agents operating together

-

Governed access to models and tools via AI and API gateways

-

Seamless integration with ERP, BI, and automation platforms

-

Model-agnostic flexibility that future-proofs investment

This is not about picking the best model today.

It is about building an execution fabric that survives change.

From AI as a Feature to AI as Infrastructure

In this architecture, assistants still exist. They are simply no longer the centre of gravity.

The centre of gravity becomes multi-agent orchestration, sitting between users and enterprise systems. Agents operate across data platforms, RAG infrastructure, enterprise applications, and automation tools under a shared governance model.

This is the shift from AI as a feature to AI as infrastructure.

And infrastructure, when done right, disappears into how work gets done.

The Enterprise Reality Check

When AI is designed this way:

-

Complexity is absorbed by the platform, not pushed onto people

-

Governance is enforced centrally, not retrofitted later

-

Integration strengthens existing systems instead of fragmenting them

-

New agents can be added without re-architecting everything

This is how organisations move from impressive pilots to durable production systems.

Not by adding more assistants.

But by orchestrating intelligence across the enterprise with an architecture built to last.

Why We Invite Organisations Early

Early engagement is not about buying technology sooner.

It is about shaping outcomes before constraints harden.

By joining early, organisations gain:

-

A private discovery and co-creation workshop focused on one high-impact workflow

-

Hands-on design of an agentic workflow aligned to real systems and policies

-

A six-week execution roadmap with clear success metrics

-

Direct access to patterns learned from over 100 enterprise deployments

This is applied experience, not theory.

The Only Question That Matters Now

The bar for enterprise performance keeps rising. Customers expect seamless experiences. Teams are under pressure to deliver more with less. Governance expectations continue to intensify.

Agentic AI is no longer optional.

If you have identified a use case and want to avoid the three mistakes that quietly kill most initiatives, the next step is deliberate.

Book a consultation.

Start with one workflow. Build it properly. And move from experimentation to production with confidence.

Dashboards:

Distinction between Display and Use value in dashboards:

You can now define Display and Use values in data modules.

The Display values are the values that you can see in a dashboard UI; the Use values are primarily for filtering logic.

Previously, defining the Display and Use values was possible only in FM packages. This feature brings the same capability to data modules and enhances consistency across dashboards and reporting. You can interact with readable values while filters apply precise underlying identifiers. For example, you can select a Customer ID value in the dashboard UI and apply a filter that is based on the Customer Name value.

Manage filter size and filter area visibility:

You can now resize filter columns and hide filter areas to improve the arrangement and visibility of these elements in dashboards.

For more information on resizing filter columns in the All tabs and This tab filter areas, see Resizing filters.

For more information on hiding and reshowing the filter areas, see Hiding and showing filter areas.

Option for users to export visualisation data to a CSV file:

You can now allow your users to export visualisation data to a .csv file.

To enable this feature, open a dashboard or a report that contains a visualisation, go to Properties > Advanced, and turn on the Allow users access to data option.

When this option is active, users can open the data tray and download the .csv file from the Visualisation data tab. Enabling this feature also adds an Export to CSV button and Export to CSV icon to the toolbar. The button is visible to the users and to the editors. If you turn off this feature, the button disappears.

Responsive dashboard layout:

The 12.1.1 release introduces a responsive layout feature for dashboards.

This feature enhances the authoring experience and usability across different devices by optimising the dashboard layout for various screen sizes, including mobile devices. You can also use it for grouping the content and organising visualisations.

To use a responsive layout, go to the Responsive tab when you create a new dashboard and select one of the available templates, as seen in the following image:

The responsive dashboard layout feature comes with the following key capabilities:

- Layout selection:

You can now choose between responsive and non-responsive layouts when you create a new dashboard.

- Adaptive widgets:

If you change the position of a panel or resize the dashboard window, the widget automatically adapts its placement and alignment.

- Intuitive resizing and swapping:

Smart alignment algorithms facilitate smooth layout transitions, while an intuitive interface makes the authoring experience smoother and more efficient.

- Drop zones for precise widget placement:

Each layout cell supports five drop zones: top, right, bottom, left, and center. You can use these zones for more control over widget placement.

- Cell deletion:

Dashboards now differentiate between empty and populated cells for accurate deletion.

- Data population:

The feature mirrors data population from the non-responsive layouts, supports drag-and-drop function, and slot item selection. If you use the copy and paste or click-add-to functions, the feature uses a smart placement logic to make sure that it adds the content to empty cells. It can also split the data between existing cells.

- Window resizing:

You can now dynamically resize a dashboard and its layout automatically adapts to the new screen size. It includes transition to a single-column or two-column layouts on smaller screens for enhanced readability.

- Printing to PDF files:

You can print the dashboard to a .pdf file in View mode and in the New Page mode.

- Nested dashboard widgets:

You can use the nested dashboard widgets as standard widgets or as containers for grouping and organising the content.

To successfully implement the responsive layout, you must make sure that the dashboard uses manifest version 12.1.1 or later and confirm widget boundaries by employing the layout grid. However, if the widgets do not render correctly, check the layout specification and verify the feature support.

Secure dashboard consumption with execute and traverse permissions:

Users can now consume dashboards with execute and traverse permissions granted to presented data, no read permission is required.

In the previous releases of IBM® Cognos® Analytics, the read permission was required for dashboards consumption. This might cause a sensitive data compromise because dashboard consumers could edit and copy such data.

Important: To strengthen the protection of data that you want to be consumed by other users, modify these users' permissions from Read to Execute and Traverse before you migrate to Cognos Analytics 12.1.1.

However, the execute and traverse permissions put some restrictions on actions that can be taken by a dashboard consumer. Therefore, the consumer cannot perform the following actions:

-

Drill up and down

-

Export

-

Narrative insights

-

Navigate

-

Open dashboards

-

Paste copied widgets into another dashboard.

-

Pin

-

Save

-

Save as a story

-

See the full data set in the data tray.

-

Share

-

Switch to Edit mode.

Personalised dashboard views:

The 12.1.1 release comes with a new feature for simplified customisation of complex dashboard designs.

A dashboard view is a feature that references a base dashboard, which contains your individual filters and settings. It supports the following customisation features:

-

Filters

-

Brushing, excluding local filters on individual visualisations

-

Bookmarks, including the ability to set the currently selected tab

You can create dashboard views only from an open dashboard and from within the dashboard studio, and only against saved dashboards. If the open dashboard is saved, a Save as dashboard view option appears in the save menu:

This operation works as a standard Save as operation. When the operation is complete, the original dashboard is still displayed. To access the new dashboard view, you must open it manually from the content navigation panel.

The dashboard views have a different icon from regular dashboards. It includes an eye overlay, which is similar to a report views icon:

You can customise a dashboard view by changing the brushing, filter, or bookmarks, and then saving the view. However, the dashboard view is essentially in a Consume mode, and you can't switch to the authoring mode. It also means that you can't access the metadata tree of the dashboard view or add extra filter controls to the filter dock. If you want your users to apply filters in a metadata column, you must first add that column to the base dashboard, even if you don't initially select any filter values.

Any updates that you make to a base dashboard automatically appear in the dashboard view, except for the custom options that you define in the dashboard view itself. You can see the changes the next time that you open the dashboard view. For example, if you delete a visualisation from the main dashboard, it no longer appears in the dashboard view.

The Save as dashboard view operation also creates a non-editable bookmark in the dashboard view. This bookmark includes the state of filters and brushing that you applied in the dashboard at the time when the dashboard view was created or last saved. When you open the dashboard view and don't select any other bookmark, this bookmark is automatically selected.

The dashboard views not only consume bookmarks from the base dashboards, but they also can have their own bookmarks. You can create them in the same way as in standard dashboards. The Cognos® Analytics UI differentiates between Shared bookmarks, so all bookmarks from the base dashboards, and My bookmarks, which are bookmarks from the dashboard view.

If you delete the base dashboard, you can't open the dashboard view, and its entry is disabled in the content navigation. All attempts to access that dashboard view by entering its URL address directly into a browser result in an error message. Also, the Source dashboard property appears as Unavailable, for example:

Reporting:

Enhanced clarity of reporting templates view:

Release 12.1.1 enhances the user experience of navigating through report templates.

When you open the Create a report page, it shows only templates that match the Report filter value. This change hides all Active Reports templates by default and makes only the Report templates visible.

You can use the Filter icon to customise your view. To maintain a personalised experience, Cognos® Analytics saves your selection in local storage or by using the cached value.

This enhancement also comes with upgraded filter labels, which reflect the current filter value, for example: Showing All Templates, Showing Report Templates, or Showing Active Report Templates.

Manage queries in the report cache:

You can manage which data queries are included in the report cache to control report performance.

For more information on the report cache, see Caching Prompt Data.

For example, queries to data sources that cannot be accessed by all users, user-dependent, might degrade the report performance.

You can exclude report performance-degrading queries from cached prompt data by setting the value of the Report cache property to No in the query property pane:

-

In the navigation menu, click Report, then Queries in the drop-down menu.

-

In the Queries pane, select a query.

-

In the Properties pane, in the QUERY HINTS section, click the Report cache property.

-

Select one of the following values:

-

Default - the query is included in the report cache

-

Yes - equivalent to the Default value.

-

No - the query is excluded from the report cache.

For multi-level queries, this value is transferred from the lowest-level to the highest-level query.

PostgreSQL audit deployment and model:

The 12.1.1 release comes with a new capability for enhanced auditing and reporting in environments that use PostgreSQL as the auditing database.

You can use a dedicated Framework Manager model and a deployment package to run reports against a PostgreSQL audit database. These resources provide a structure for analysing the audit data and creating insightful reports.

You can access the new samples in the following locations within your installation directory:

<installation>/samples/Audit_samples/Audit_Postgres

<installation>/samples/Audit_samples/IBM_Cognos_Audit_Postgres.zip

To use the PostgreSQL audit samples, make sure to create a data source connection named Audit_PG.

Master detail relationships with 11.1 visualisations:

You can use 11.1 visualisations in master detail relationships to present details for each master query item in a consolidated, insightful way.

For more information on master detail relationships, see Master detail relationships.

For the 11.1 visualisations as the detail objects, you can now choose if the same automatic value range is used in all visualisation instances in a master detail relationship. You apply your choice to the Same range for all instances of the chart option. To turn this option off or on, perform the following steps:

-

Select a visualisation for which a master details relationship is created.

-

In the Data Set pane of this visualisation, click the data item that defines values on the value axis.

-

In the Properties pane, under GENERAL, click the More icon 3 dots in the filter area right of the Value range property.

-

In the Value range window:

-

Select Computed.

-

Turn off or on the Same range for all instances of the chart option, depending on whether you want to use in the instances the global extrema, the biggest value range of all instances, or the local extrema, the value range of each visualisation.

If you’re a TM1 professional and have been near the finance or FP&A world lately, you’ve probably heard the buzzword of the season: Agentic AI.

It sounds fancy and must have wondered why suddenly everyone is talking about it, but honestly, it’s just AI that doesn’t sit around waiting for you to poke it. It does things — proactively and automatically.

And when you mix that with platforms like IBM Planning Analytics / TM1, things start getting interesting.

So… What Exactly Is Agentic AI?

Imagine if your TM1 rules, processes, and chores had a brain.

Not just “if X then Y”, but something that can:

-

Notice something’s off

-

Decide what to do

-

Do it

-

Tell you what it did

-

Learn from the outcome

That’s, in a nutshell, agentic AI in the TM1 paradigm.

Think of it as giving your FP&A stack its own mini team member — minus the coffee breaks or the usual shenanigans that you’ve to bear with daily.

In practical terms, agentic AI can help rather than just be a buzzword decoration floating around in everyone’s LinkedIn posts or formal/informal conversations.

I like to highlight below a few basic things - yet very important – that agentic AI is really good at doing:

1. Automated Data Babysitting (Finally!)

Every TM1 admin knows the pain: source system changes, missing records, late files… chaos.

Agentic AI can:

- Watch data pipelines for delays

- Fix formatting issues on the fly for your TI process

- Alert you before the morning refresh explodes

Basically, your nightly chore is that you just hired an assistant.

2. “Hey, Something’s Wrong” Alerts (That Make Sense)

Instead of a typical TM1 process error message that looks like it was written in 1995, agentic AI can:

- Spot outliers, bad allocations, weird spikes – something you would do manually otherwise

- Compared to historical patterns

- Tell you, in plain English, why it’s weird

Something along the lines of:

“Hey, sales in APAC are 4x higher than normal for Mondays. It could be a missing filter. Want me to check?”

Yes, please.

3. Forecasting That Doesn’t Feel Like Guesswork

Sure, TM1 can forecast, and it can predictive forecast really well.

But agentic AI can simulate scenarios on its own and recommend the best one.

Examples:

- Auto-build 20+ what-if scenarios

- Rank them based on risk or probability

- Push the best one straight into a cube

It’s like giving your CFO a crystal ball… a slightly nerdy one.

4. TM1 Admin Tasks… Done Automatically

This is the part TM1 developers love.

Agentic AI can:

-

Fix failing processes

-

Rewrite TurboIntegrator code

-

Clean up unused object

-

Suggest how to reduce the cube size

Admittedly, given it's all subjective, and it's easier said than done, but the possibilities do exist with the more quality data we can ingest and the more we can train the model.

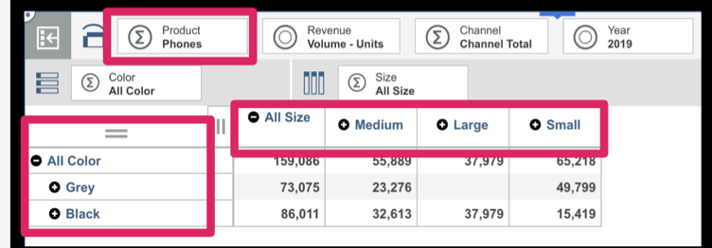

5. Natural Language Access to TM1

We’ve already seen this with AI chat Assistant in PAW where instead of navigating a million cubes and views, we can prompt Planning Analytics such as, “Give me gross margin by product for Q3 vs last year and show me drivers of variance.”

And it does it a fine job.

No view-building. No subset drama. No filter pain.

6. Real-time Decision Automation

Finance teams love workflows and agentic AI is perfect for building the workflows.

It loves automating those workflows.

-

Approve expenses based on policy

-

Kick off TM1 processes when thresholds hit

-

Trigger emails, Teams alerts, Slack actions

-

Update commentary automatically

So instead of actively entering the forecasts or budgets, the agent proactively taking steps to initiate those steps for you.

With time, we’re only going to see more of:

-

AI agents running close cycles

-

AI agents building dashboards

-

AI agents talking to ERP, CRM, S3, APIs without humans touching integrations

-

AI agents are debugging your model while you sleep

Why TM1 Specifically Is a Perfect Fit

As we know, TM1 is:

-

Real-time

-

Calculation-heavy

-

Highly scriptable

-

Connected to everything

-

Used for tons of repetitive work

Which is exactly the playground where agentic AI thrives.

Plus, TM1 developers are already half-cyborg 😉 with the stuff they automate — agents just take it further.

So the biggest takeaway from all of this is that Agentic isn’t coming “in the future”, it's already there! Things are definitely moving and moving at a very fast rate in this space.

It’s already sliding into FP&A tools, APIs, planning models, and the daily grind of finance teams. If TM1 was the engine, then agentic AI is the turbocharger bolted on top.

And yes — as a disclaimer, it might even finally stop your chore from failing at 3 AM for no reason 😉

Procurement teams today are under pressure to move faster, reduce risk, and operate with greater transparency. Yet contract review — one of the most critical procurement responsibilities — remains slow, manual, and highly inconsistent across most organisations.

A major enterprise client came to Octane facing exactly this challenge. Their procurement function was overwhelmed: contracts were buried in inboxes, reviews took hours, and comparing updated versions created delays and negotiation blind spots.

Octane delivered a powerful, AI-enabled solution using IBM WatsonX Orchestrate — combining a Contract Analyser with an intelligent Ask Procurement interface. Together, these capabilities have redefined how the client manages contract intake, review, insights, and procurement intelligence at scale.

The Business Challenge

The client’s procurement team was experiencing significant bottlenecks:

-

Contract overload and inbox chaos

Supplier agreements arrived via email and were often lost or delayed, slowing downstream purchasing decisions.

-

Time-consuming manual analysis

Procurement staff could spend 1–3 hours per contract summarising content, identifying risks, and preparing commentary for stakeholders.

-

Difficulty comparing contract versions

Updated supplier contracts required line-by-line manual comparison, often leading to missed red flags and weaker negotiation leverage.

-

Limited visibility into procurement insights

Leaders had no quick way to query procurement data, trends, supplier risks, or anomalies.

These issues created avoidable risk, slowed procurement cycles, and stretched team capacity.

The Octane Solution: AI-Enabled Contract Analyser + Ask Procurement

Octane deployed a streamlined, automated solution powered by IBM WatsonX Orchestrate that addresses both contract processing and procurement intelligence.

✔ AI Contract Analyser

The analyser automatically:

-

Captures new supplier contracts the moment they appear in email

-

Extracts and understands contract text

-

Summarises key clauses and obligations

-

Identifies risks, red flags, and missing components

-

Highlights differences between contract versions

-

Generates a negotiation playbook

-

Delivers insights to stakeholders instantly

This means procurement teams no longer read contracts line-by-line — the AI does the heavy lifting.

✔ Ask Procurement: AI interface for procurement intelligence

As part of the deliverable, Octane introduced Ask Procurement, a conversational AI interface that allows users to:

-

Query procurement data

-

Identify spend trends

-

Detect anomalies in contracts or vendors

-

Access historical contract insights

-

Surface negotiation patterns

-

Review supplier performance indicators

Whether it’s “Show me all suppliers with auto-renewal clauses” or “Summarise risk trends for our top five vendors,” Ask Procurement provides instant answers.

Together, these tools create a true digital procurement co-pilot.

The Impact for the Client

The benefits have been significant and immediate:

-

Review time reduced to under a minute

What previously took hours now happens automatically — contracts are analysed, summarised, and compared in seconds.

-

Reduced legal and commercial risk

The AI produces a structured risk register, helping teams spot issues earlier and make more informed decisions.

- Stronger negotiation positions

The system highlights:

-

What changed between versions

-

Why it matters

-

Recommended negotiation arguments

This gives the procurement team a consistent, data-driven advantage.

-

Faster procurement cycle times

Automated intake and instant insights have removed bottlenecks, improving:

- Supplier onboarding

- Purchase approvals

- Contract turnaround times

-

No more lost contracts

The AI automatically captures, stores, and processes every attachment.

-

Improved organisational intelligence

With Ask Procurement, leaders now have:

-

Instant visibility

-

Searchable procurement knowledge

-

On-demand insights

-

Clear trend analysis

This shifts procurement from reactive to proactive.

Why This Matters

This project demonstrates what applied enterprise AI looks like in the real world — practical, operational, and immediately beneficial.

It shows how organisations can:

-

Modernise procurement without replacing systems

-

Automate high-effort tasks with intelligent workflows

-

Strengthen compliance and governance

-

Provide teams with insights previously locked away in documents

-

Use AI as an everyday digital procurement analyst

It also reinforces that AI is not only for futuristic use cases — it is delivering meaningful value today.

What’s Next: Full Lifecycle Automation with E-Signature

The next extension is already underway:

AI-driven e-signature workflows, enabling:

-

Automated signing

-

Routing and approval

-

Audit trails

-

Archiving and version control

This will close the loop across the entire procurement lifecycle:

Intake → Review → Insights → Decision → Signature → Storage

Conclusion

Octane’s AI Contract Analyser and Ask Procurement portal offer a new way forward for procurement teams looking to accelerate productivity, reduce risk, and enhance decision-making.

By combining IBM WatsonX Orchestrate, structured AI reasoning, and deep procurement expertise, Octane has delivered a real-world, production-ready solution that transforms how contracts — and procurement intelligence — are managed at scale.

If you'd like to explore how this could work inside your organisation, the Octane team is ready to demonstrate what’s possible.

In today’s volatile business landscape, agility is no longer a competitive advantage—it’s a necessity. True agility means moving beyond fast response to actively anticipating market shifts and seamlessly aligning people, processes, and technology to act decisively.

.png?width=595&height=341&name=From%20Insight%20to%20Impact%20(1).png)

Enterprises possess vast troves of data, yet the ultimate differentiator is the ability to transform that data into actionable insights and automated, intelligent decisions. At Octane Analytics, we are driving this transformation across industries by evolving disconnected reporting tools into a unified, intelligent ecosystem powered by IBM's premier analytics and AI platforms.

The Unified Framework for Intelligent Decisions

IBM’s comprehensive suite of solutions—including Planning Analytics, Cognos Analytics, SPSS, Decision Optimisation, Controller, and Watsonx Orchestrate—delivers a connected framework that manages business performance from strategic vision through to operational execution. This integration establishes a data-to-decision continuum where insights fluidly integrate into planning, execution, and automation cycles.

- IBM Planning Analytics moves organisations beyond static budgeting to dynamic, driver-based forecasting and scenario modelling.

- IBM Cognos Analytics empowers business users with AI-driven dashboards and visualisation tools for deep insight exploration.

- IBM SPSS integrates statistical precision and data science into business planning, ensuring predictions are rooted in reliable data, not intuition.

- IBM Decision Optimisation models complex business scenarios to identify the most efficient and optimal outcomes.

- IBM Controller simplifies and automates financial consolidation, closing, and regulatory reporting.

- IBM Watsonx Orchestrate enables non-developers to automate repetitive workflows, directly connecting insights to business action without writing code.

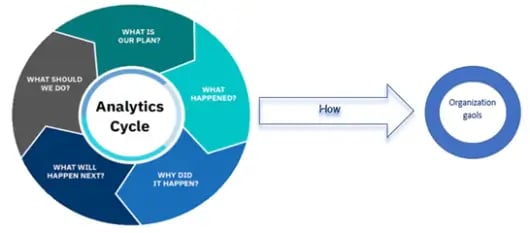

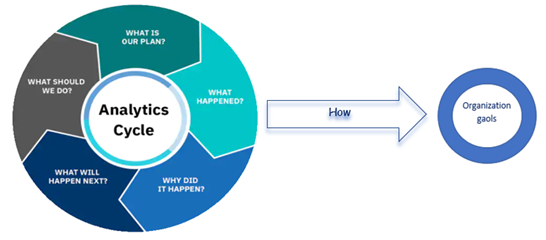

The Pivot to Predictive and Prescriptive Analytics

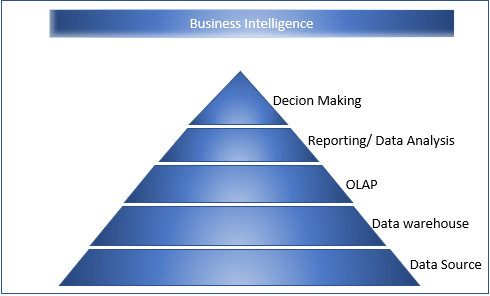

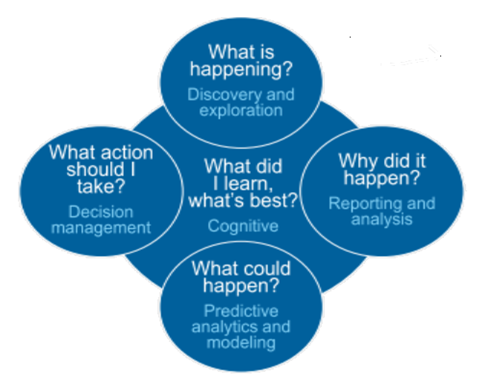

Many organisations remain reactive, focused on analysing "what happened." The step-change in performance occurs when analytics shift to answering the crucial questions: “what will happen?” (Predictive) and “what should we do about it?” (Prescriptive).

The integrated IBM ecosystem facilitates this critical shift:

-

Prediction Informs Strategy: Predictive models built in SPSS directly inform forecasts within Planning Analytics, making financial and operational plans immediately responsive to market shifts.

-

Prescription Optimises Action: Decision Optimisation identifies the best sequence of actions to achieve a business goal, operating within specified constraints.

-

Automation Operationalises Insight: Watsonx Orchestrate then automates the prescribed follow-up actions—whether triggering workflows in HR, Finance, or Operations—significantly boosting responsiveness and reducing manual workload

This synergy elevates the organisation from merely data-driven to decision-driven, where insights are not just observed but fully operationalised.

AI and Automation: Transforming Finance and Operations

Automation is no longer confined to the IT department. Today, modern CFOs, HR executives, and department leaders are leveraging agentic AI to offload repetitive, high-volume tasks and achieve new levels of efficiency.

Consider the impact across key functions:

- Financial Performance Management: Imagine a Finance Manager who automatically receives consolidated reports prepared by the IBM Controller, reviewed with AI-assisted insights from Cognos Analytics, and validated against dynamic budget forecasts from Planning Analytics.

- Intelligent HR Operations: A People Leader uses Watsonx Orchestrate to streamline repetitive HR tasks—from scheduling interviews and summarising resumes to ensuring records are instantly updated across all ERP systems.

At Octane Analytics, we specialise in designing and deploying these agentic AI ecosystems, ensuring automation amplifies human capability and drives measurable outcomes.

Why Choose Octane Analytics?

As an IBM Gold Partner, Octane Analytics offers deep, specialised expertise in integrating and optimising IBM’s entire performance management stack.

Our approach is centred not just on product deployment, but on measurable business outcomes: enhanced agility in planning, increased accuracy in forecasting, greater efficiency in reporting, and empowerment through automation.

Whether your immediate need is strategic financial consolidation or a full-scale enterprise performance management overhaul, our team provides the expertise to define the roadmap, deliver the integrated solution, and ensure a demonstrable Return on Investment (ROI).

The Future: A Connected, AI-Powered Enterprise

The future of enterprise performance hinges on connected intelligence—an environment where AI and analytics continuously learn, adapt, and act across all business functions.

Organisations that master this integrated, AI-first approach will not only achieve operational efficiency but also build unparalleled resilience and foresight in a rapidly changing global market. At Octane Analytics, we are committed to helping enterprises realise this future, one intelligent decision at a time.

Let’s Build the Intelligent Enterprise Together

If you are exploring how integrated AI, advanced analytics, and automation can significantly elevate your business performance, we invite you to connect with us. Our team can provide tailored, real-world use case demonstrations—from predictive planning to automated workflow execution—all powered by IBM’s market-leading technology.

📩 Reach out to Octane Analytics today to schedule a discovery session.

IBM Planning Analytics AI assistant - revolutionising business planning with artificial intelligence

In today’s fast-paced business environment, companies are constantly looking for ways to streamline their operations, improve decision-making, and stay ahead of the competition. One of the tools that has gained significant attention in the world of business intelligence and analytics is IBM Planning Analytics, which harnesses the power of AI to enhance financial planning, forecasting, and reporting. One of the standout features of IBM Planning Analytics is its AI Assistant, an innovative tool that leverages artificial intelligence to provide smarter, more efficient planning and analytics capabilities.

In this blog, we’ll dive into the key features of the IBM Planning Analytics AI Assistant and explore how it is transforming business planning for organisations around the world.

What is IBM Planning Analytics AI Assistant?

IBM Planning Analytics is a cloud-based solution designed to help businesses automate their planning, budgeting, forecasting, and analysis processes. The AI Assistant embedded within the platform brings cognitive capabilities to the table, making it more intuitive and user-friendly.

The AI Assistant uses natural language processing (NLP) and machine learning algorithms to understand and respond to user queries in plain language, enabling business users—whether financial analysts, planners, or executives—to interact with the system more naturally. Instead of relying on complex formulas or spending hours running reports, users can simply ask questions like, "What was our sales growth in Q3?" or "How much did our expenses increase year-over-year?" The AI Assistant then processes these requests and provides quick, data-driven insights.

Key Features of IBM Planning Analytics AI Assistant

-

Conversational analytics

One of the most impressive features of the AI Assistant is its ability to enable conversational analytics. Traditionally, getting insights from business intelligence tools involved navigating through multiple layers of data, setting up reports, or writing complex queries. The AI Assistant eliminates this complexity by allowing users to ask questions in natural language, just like they would talk to a colleague or consultant.

For example, a user can ask, "What were our sales for last quarter?" and the AI Assistant can instantly pull up relevant data, graphs, or reports. This conversational interface makes it easier for non-technical users to engage with analytics and access valuable insights without having to be data experts.

-

Data-driven decision-making

The AI Assistant doesn’t just provide static answers—it actively helps users analyse trends, identify anomalies, and make data-driven decisions. For instance, the Assistant can compare historical data, identify seasonal patterns, and even suggest potential adjustments to forecasts based on changing market conditions. This empowers decision-makers to quickly assess different scenarios and make informed choices.

Additionally, the Assistant can provide context behind the data, such as explanations of why certain numbers are trending upward or downward. This deeper level of understanding enables organisations to plan with greater confidence.

-

Predictive analytics and forecasting

In addition to assisting with retrospective analysis, the AI Assistant is also equipped to help users with predictive analytics. Using historical data, market trends, and other variables, the Assistant can generate forecasts for various business aspects like sales, revenue, and operational costs.

For instance, planners can ask the AI Assistant, "What is the projected revenue for the next quarter based on current trends?" The Assistant then leverages machine learning models to provide accurate, forward-looking forecasts. By incorporating AI-driven insights, businesses can improve their planning accuracy and reduce the risks associated with manual forecasting.

-

Automated insights and recommendations

One of the standout benefits of AI in business planning is its ability to go beyond simple reporting. The IBM Planning Analytics AI Assistant is capable of delivering automated insights and recommendations that are tailored to the needs of the organisation. By analysing past performance, the Assistant can highlight areas of opportunity or potential risk that may require attention.

For example, if expenses are increasing faster than revenue, the Assistant might recommend strategies for cost-cutting or optimising operations. These automated recommendations allow planners and analysts to quickly address potential issues and capitalise on emerging opportunities.

-

Seamless integration with IBM Planning Analytics Workspace

The AI Assistant is fully integrated with the IBM Planning Analytics Workspace, which is the central hub for business users to manage and analyse data. This integration ensures that users have a smooth experience when interacting with their data, whether they are leveraging the AI Assistant for ad-hoc analysis or using the broader tools available in Planning Analytics for long-term strategic planning.

The seamless integration between the Assistant and the workspace also means that businesses can continue to rely on traditional data management and reporting workflows while taking advantage of AI-powered insights without disruption.

Benefits of IBM Planning Analytics AI assistant

.png?width=579&height=332&name=AI%20in%20finance%20and%20watsox%20orchestrate%20(2).png)

-

Faster Decision-Making

The AI Assistant accelerates decision-making by delivering insights in real-time. Users can ask questions and get answers instantly, without having to manually sift through large datasets or run complex queries. This speeds up planning cycles and ensures that decisions are based on the latest data.

-

Empowerment of Business Users

With the AI Assistant, business users who may not have deep technical expertise can now access analytics and make informed decisions. This democratisation of data ensures that all teams—finance, marketing, operations—are equipped to contribute to planning processes and drive organisational success.

-

Reduced Errors

Since the AI Assistant uses machine learning models to predict and analyse data, the likelihood of human error in forecasting and planning is significantly reduced. Automated insights and recommendations are based on sophisticated data analysis, helping to eliminate mistakes caused by manual data handling.

-

Scalable Insights Across Teams

The AI Assistant enables businesses to scale their analytics capabilities across teams and departments. Whether a team is working on financial forecasts, sales targets, or operational efficiencies, the Assistant can be used to generate insights that are relevant to each department’s specific goals and objectives. This scalability ensures that AI-powered decision-making benefits the entire organisation.

Real-World Use Cases

-

Finance Teams

For finance teams, the AI Assistant is a game-changer in managing budgets, forecasting, and scenario planning. It can quickly identify deviations from expected results, recommend corrective actions, and forecast the financial outlook based on real-time data.

-

Sales and Marketing Teams

Sales and marketing teams can use the Assistant to gain quick insights into customer behaviour, sales trends, and marketing ROI. By understanding which campaigns are driving results and which aren’t, they can adjust strategies on the fly and optimise their efforts.

-

Operations and Supply Chain

Operations managers can use the AI Assistant to forecast demand, optimise inventory, and predict potential supply chain disruptions. By understanding these dynamics earlier, businesses can mitigate risks and improve operational efficiency.

Conclusion

The IBM Planning Analytics AI Assistant represents a significant leap forward in the world of business analytics. By combining artificial intelligence, natural language processing, and predictive analytics, it transforms the way businesses plan, forecast, and make decisions. With its ability to provide faster insights, automate recommendations, and empower users across the organisation, the AI Assistant is not just a tool—it’s a strategic asset that helps businesses become more agile and data-driven in their operations.

As businesses continue to face increasingly complex challenges, tools like IBM Planning Analytics AI Assistant will become indispensable for navigating the future of planning and decision-making.

Ready to take AI to the next level? Talk to us!

The world of finance is evolving rapidly, and AI is no longer a futuristic concept—it’s a practical tool that can transform how finance teams operate. But for many organisations, the idea of integrating AI into their workflows can feel overwhelming. Where do you start? How do you ensure success? The answer lies in taking a gradual, strategic approach. With Watson Orchestrate and IBM Planning Analytics, you can start small, prove the value, and confidently scale your AI initiatives. At Octane, we guide you through this journey, from exploring use cases to delivering impactful projects.

Why Start Small with AI in Finance?

AI has the potential to revolutionise finance by automating repetitive tasks, enhancing decision-making, and improving accuracy. However, diving headfirst into a full-scale AI implementation can be risky. Starting small allows you to test the waters, build confidence, and demonstrate tangible results before committing to larger investments. This is where Watson Orchestrate shines—it’s designed to integrate seamlessly with your existing tools, like IBM Planning Analytics, and automate specific tasks without disrupting your workflows.

Step 1: Explore Use Cases with Octane’s Workshops

The first step in your AI journey is identifying where it can add the most value. We work closely with IBM client engineering team and run interactive workshops to help you explore potential use cases for Watson Orchestrate within your finance team. These workshops are designed to:

- Understand Your Pain Points: We work with your team to identify repetitive, time-consuming tasks that are ripe for automation, such as data consolidation, report generation, or budget reconciliation.

- Brainstorm Solutions: Together, we brainstorm how Watson Orchestrate can address these challenges, leveraging its AI capabilities to automate processes and enhance efficiency.

- Prioritise Opportunities: Not all use cases are created equal. We help you prioritise the ones that offer the quickest wins and the highest impact.

Step 2: Prove the Value with a Proof of Concept (POC)

Once we’ve identified promising use cases, the next step is to validate them through a Proof of Concept (POC). A POC allows you to see Watson Orchestrate in action, delivering real results in a controlled environment. Here’s how it works:

- Define Success Metrics: We work with you to define clear objectives and success metrics for the POC, ensuring that the results are measurable and aligned with your goals.

- Build and Test: Our team builds the POC, integrating Watson Orchestrate with IBM Planning Analytics to automate the selected use case. We test the solution rigorously to ensure it meets your requirements.

- Evaluate Results: After the POC, we evaluate the results together. Did it save time? Improve accuracy? Enhance productivity? These insights help you decide whether to move forward with a full-scale implementation.

Step 3: Deliver the Project and Scale

If the POC demonstrates value, we move into the project delivery phase. Our team works closely with yours to implement the solution, ensuring it’s tailored to your specific needs and integrated seamlessly into your workflows. Once the initial project is delivered, you can scale the solution to address additional use cases, gradually expanding the role of AI in your finance operations.

Real-World Impact: A Gradual Approach to AI

Many organisations have successfully adopted AI in finance by starting small and scaling strategically. For example, an airline participated in one of Octane’s workshops and identified report generation as a key pain point. Through a POC, they automated the process using Watson Orchestrate, reducing the time required from 2 days to just 30 minutes. Encouraged by the results, they expanded the solution to automate budget reconciliation, achieving even greater efficiencies.

Why Choose Octane?

At Octane, we specialise in helping organisations like yours navigate the complexities of AI adoption in Finance teams. Our phased approach—starting with workshops, moving to POCs, and then delivering projects—ensures that you can dip your toes into AI without taking on unnecessary risk. We bring deep expertise in Watson Orchestrate and IBM Planning Analytics, along with a commitment to delivering measurable results.

Take the First Step Today

AI is no longer a distant dream—it’s a practical tool that can transform your finance team. By starting small with Watson Orchestrate and IBM Planning Analytics, you can explore the potential of AI, prove its value, and scale your initiatives with confidence. Ready to get started? Contact Octane today to schedule a workshop and begin your AI journey. Email us at media@octanesolutions.com.au to learn more.

The future of finance is AI-powered, and the journey starts with a single step. Let Octane guide you every step of the way.